Experts Weigh in On The Bank Of Canada Interest Rate Decision And What’s Ahead

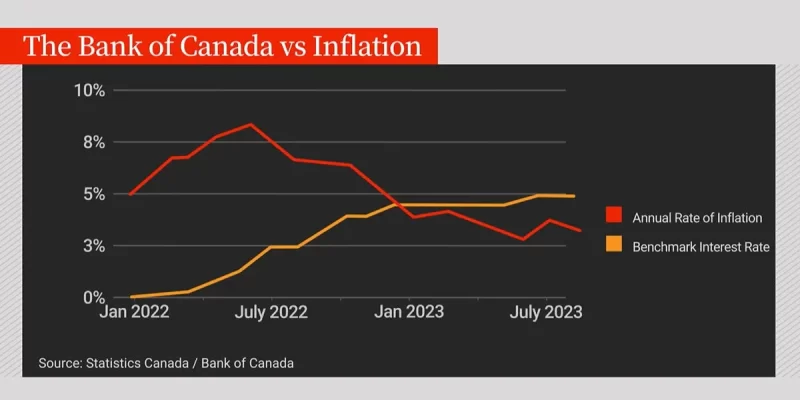

The Bank of Canada kept its interest rate unchanged at 5% today, a move that analysts widely expected given recent economic data. While holding steady for now, Governor Tiff Macklem signaled that conditions are right for a cut, pending more evidence of sustained progress on reining in inflation.

Experts largely saw the decision as prudent but anticipate reductions over the coming months to help support the economy. “If things continue to evolve the way we expect on inflation, it will be appropriate to lower interest rates this year,” said Warren Lovely, chief rates strategist at National Bank Financial. Most analysts forecast the first cut coming as early as June.

What Lies Ahead

Tu Nguyen of RSM Canada argued waiting beyond June risks “acting too little too late” as disinflation takes hold. Several factors are cooling price pressures, like moderating commodity prices and China exporting deflation abroad. Still, Phil Mesman of Picton Mahoney noted U.S. inflation remains stubbornly high, posing a challenge for the Bank of Canada to diverge from its neighbor’s more hawkish path.

Brooke Thackray of Horizons ETFs said Canadians are strained by high costs of living, placing the central bank in a “difficult spot.” While inflation has slowed, it remains above the 2% target. Macklem will need further proof it’s firmly declining before easing interest rates to provide more accommodation. Most analysts foresee two to three reductions this year to help offset economic headwinds.