Financial Watchdog Warns of Vulnerabilities in Venmo and Other Payment Apps

The Consumer Financial Protection Bureau (CFPB) has issued a warning advising customers of payment apps such as Venmo, PayPal, and CashApp against storing their money in these apps for the long term.

The CFPB cautions that funds held in these apps may not be safe during a financial crisis, as they are not protected by deposit insurance like traditional bank accounts.

This alert follows recent bank runs experienced by Silicon Valley Bank, Signature Bank, and First Republic Bank, where customers withdrew their uninsured deposits in response to fear and uncertainty.

Unlike traditional bank accounts, money stored in Venmo, CashApp, and Apple Cash is not held in a traditional bank account and therefore lacks deposit insurance coverage.

In the event of a crisis or bank run, funds stored in these payment apps may be at risk of loss.

While some funds in these apps may be eligible for pass-through insurance coverage through certain activities, the default protection is generally not provided.

For instance, opening a PayPal Savings account through PayPal’s partner bank, Synchrony Bank, can provide deposit insurance, but regular PayPal accounts are not cover.

Similarly, Apple Cash can be insure through Green Dot Bank, but identity verification is require to obtain deposit insurance.

Risks and Consumer Awareness About Payment Apps

The CFPB’s report highlights the potential risks associated with storing funds in nonbank payment platforms. Consumers may not fully understand the circumstances under which their funds would be protect by deposit insurance.

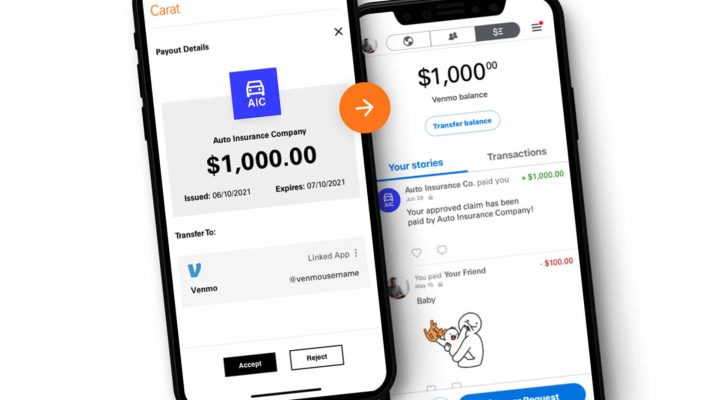

The popularity of peer-to-peer payment apps and non-banks offering bank-like services has surged in the last decade, with millions of customers relying on these apps.

Venmo alone boasts over 90 million customers and recently expanded its services to include accounts for teenage children.

Apple also introduced a savings account tied to its Apple Card, attracting billions of dollars in deposits within a few days.

The Financial Technology Association, representing PayPal and Block, the owner of Cash App, reassured consumers of the safety of these products.

The association emphasized that payment apps provide transparency and safety, with users potentially receiving FDIC insurance coverage on their accounts depending on the specific products used.

However, the CFPB’s warning serves as a reminder for customers to understand the limitations and potential risks associated with storing money in payment apps.

The Consumer Financial Protection Bureau’s warning highlights the potential vulnerabilities of storing money in payment apps such as Venmo, PayPal, and CashApp.

Without the protection of deposit insurance like traditional bank accounts, funds held in these apps may be at risk during financial crises.

As the popularity of nonbank payment platforms continues to grow, it is essential for consumers to be aware of the potential risks and limitations involved in storing their money in these apps.