March CPI Inflation Rate Holds Steady, Dampening Hopes of an Imminent Fed Rate Cut

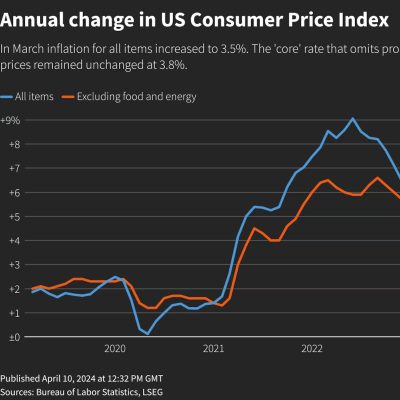

The March CPI Inflation Rate data released yesterday painted a concerning picture, with both overall and core inflation climbing higher than analysts forecasted. The headline rate rose 0.4% month-over-month to 3.5% year-over-year, while the core rate excluding food and energy increased 0.4% as well, keeping its annual rate steady at 3.8%. This hotter-than-expected CPI Inflation Rate data dashed hopes that inflation was slowing substantially.

A closer look at the March CPI Inflation Rate report revealed inflationary pressures spreading beyond just gas prices. The index for medical care services increased sharply, with hospital and health insurance prices rising significantly. Transportation costs also climbed considerably. These widespread inflation gains signal the Federal Reserve still has more work to do in taming price pressures.

How Did Markets React To The March CPI Rate News?

In reaction to the March CPI Inflation Rate data, market expectations for Fed interest rate cuts this year fell dramatically. Fed fund futures showed the probability of a rate cut by June dropped from over 50% before the report to just 19% after. Overall odds for multiple quarter-point cuts in 2023 also declined sharply. The S&P 500 index opened lower on the news but pared losses as the session progressed, finishing down a modest 0.7% for the day. Still, stocks remain sensitive to any signs inflation is cooling more slowly than hoped.

Going forward, investors will watch subsequent inflation reports closely for confirmation the CPI Inflation Rate has peaked and is beginning to moderate back toward the Fed’s 2% target. April’s producer price index data due out this week will provide another clue on price pressures. But for now, March’s hotter-than-expected CPI Rate reading suggests the central bank may need to remain aggressive in tightening monetary policy to tame inflation.