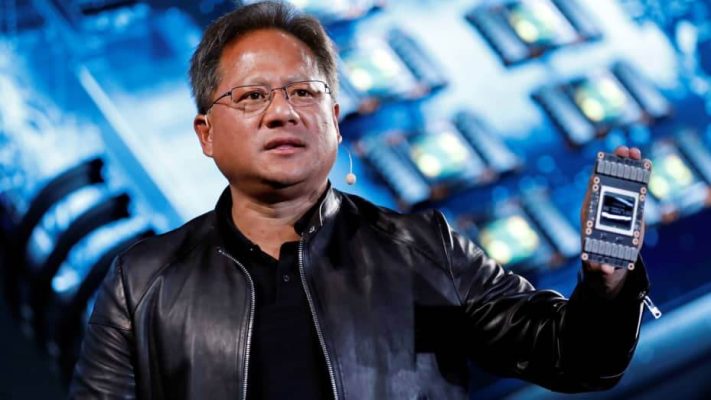

Nvidia Shares Spike 26% on Surging Demand for AI Chips, Beating Forecasts

Nvidia, a leading technology company, experienced a remarkable surge in Nvidia shares spike, jumping 26% in response to its strong first-quarter earnings for fiscal year 2024.

The impressive performance was primarily driven by the surging demand for Nvidia’s artificial intelligence (AI) chips, exceeding market forecasts.

Nvidia’s first-quarter results for the period ending in April surpassed expectations. Leading to a 26% spike in Nvidia shares during extended trading.

The company achieved an adjusted earnings per share (EPS) of $1.09, outperforming the estimated 92 cents.

Additionally, Nvidia generated $7.19 billion in revenue, surpassing the anticipated $6.52 billion. These remarkable results exceeded Wall Street’s predictions, generating significant investor enthusiasm and driving the surge in Nvidia shares.

Surging Ahead with Strong Forecasts for Nvidia Shares Spike

For the current quarter, Nvidia anticipates sales of approximately $11 billion. Representing over a 50% increase compared to Wall Street’s estimate of $7.15 billion.

This robust forecast highlights Nvidia’s confidence in the future demand for its products and reaffirms. Its leading position in the AI chip market.

Prior to the after-hours surge, Nvidia shares spike had already experienced a remarkable 109% increase in 2023. Largely driven by optimism surrounding the company’s AI offerings.

Nvidia’s data center group reported sales of $4.28 billion, surpassing the expected $3.9 billion and reflecting a 14% annual increase.

The substantial growth can be attributed to the escalating demand for Nvidia’s GPU chips from cloud vendors and major consumer internet companies.

These entities rely on Nvidia chips to train and deploy generative AI applications, including OpenAI’s ChatGPT.

The strong performance of Nvidia’s data center division underscores the increasing importance of AI chips. For cloud providers and businesses operating large-scale server networks.

Challenges in the Gaming Division

Despite Nvidia’s remarkable success in the data center segment, its gaming division faced challenges, experiencing a 38% drop in revenue to $2.24 billion compared to the expected $1.98 billion.

The decline was primarily attributed to a slower macroeconomic environment and the gradual release of Nvidia’s latest gaming GPUs.

However, Nvidia remains a dominant player in the gaming industry, and upcoming product launches are expected to reinvigorate the gaming division.

Nvidia’s automotive division, specializing in chips and software for self-driving car development, achieved significant year-over-year growth of 114%.

However, sales for the quarter remained relatively modest, totaling under $300 million.

Nevertheless, this expansion highlights Nvidia’s commitment to advancing autonomous vehicle technology and its potential for long-term growth within the automotive industry.

Nvidia’s outstanding Q1 performance, driven by the escalating demand for AI chips, led to substantial Nvidia shares spike in its shares.

The remarkable growth of Nvidia’s data center group underscores the increasing significance of AI chips for cloud providers and businesses operating large-scale server infrastructures.

While the gaming division faced challenges, Nvidia’s dominant position in the industry remains intact. With promising prospects in the automotive sector, Nvidia continues

Why Are Nvidia Shares Rising

NVIDIAs stock has been, on the rise recently thanks to developments in the companys operations. Although I couldn’t find articles explaining why NVIDIAs shares are increasing in 2024 we can understand from their third quarter fiscal report for that year that the company has experienced significant growth across different sectors.

For instance their gaming revenue saw a boost due to the introduction of products and an expansion of games available on their GeForce NOW platform. The professional visualization division also witnessed revenue growth partly attributed to companies, like Mercedes Benz utilizing NVIDIA Omniverse for creating twins.

Moreover their automotive sector demonstrated progress through collaborations aimed at developing generation vehicles.