Canadian CPI Falls Short of Expectations in February

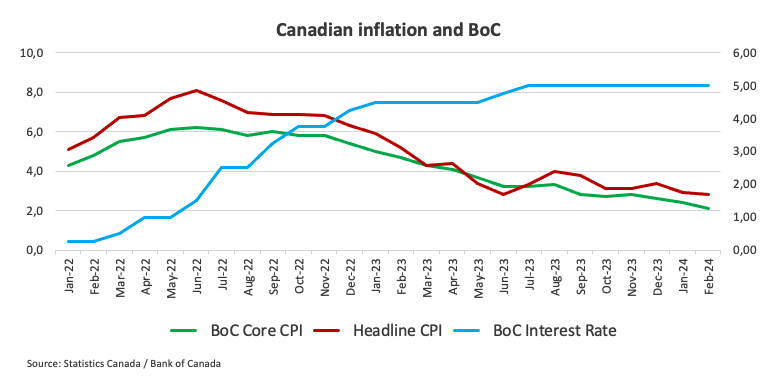

The Canadian CPI rose 2.8% annually last month, falling short of forecasts for a 3.1% gain. On a monthly basis, inflation rose 0.3% in February. Core inflation, which excludes volatile food and energy prices, rose 2.1% year-over-year.

Grocery prices, a key component of the Canadian CPI, saw slower growth last month compared to headline inflation. Food prices purchased from stores increased 2.4% versus 3.4% in January. Price increases for items like fresh fruit, processed meat, and fish all declined.

While inflation remains above the Bank of Canada’s 2% target, the weaker-than-expected Canadian CPI data could impact expectations for further interest rate hikes. The central bank has been aggressively raising rates to rein in high inflation, taking its policy rate to 1% so far in 2022.

What Does this Mean for Interest Rates?

The softer Canadian CPI print in February may ease some concerns at the Bank of Canada about runaway inflation pressures. While price increases remain elevated, slowing grocery costs and decelerating inflation could give the central bank room to pause its rate hiking plans going forward. Investors will be watching upcoming Canadian CPI reports closely for signs of whether inflation is peaking or if further rate hikes may still be needed to get prices under control.

With inflation showing tentative signs of easing, the odds of the Bank of Canada raising rates by a full 50 basis points at its next policy meeting may have diminished. However, much will depend on upcoming economic data and whether the Canadian CPI slowdown last month is the start of a lasting trend or just a temporary blip.