Property Tax Lookup in Toronto

Every homeowner must understand property taxes. This tax contributes significantly to Toronto’s revenue and is use to pay a variety of public services. This post provides a detailed guide on property tax lookup in Toronto and helps you understand how it is calculated and paid.

Table of contents

- What is Property Tax?

- The Importance of Property Tax

- Property Tax in Toronto

- How Property Tax is Calculated in Toronto

- How to Look Up Property Tax in Toronto

- Understanding Your Property Tax Bill

- How to Pay Your Property Tax in Toronto

- Property Tax Relief Programs in Toronto

- Final Thought

- Youtube Video About Property Tax Lookup in Toronto

- You May Also Like

- FAQ

What is Property Tax?

A property tax is a levy on property that the owner must pay. The amount is set by the local government and is usually dependent on the property’s worth.

Also property tax money is used to pay public services such as schools, roads, and infrastructure.

The Importance of Property Tax

Property tax lookup in Toronto is not just another bill to pay. It makes an important contribution to the smooth operation of your neighbourhood.

Property tax revenue is utilised to fund critical services such as public education, law enforcement, fire protection, road repair, parks, and recreation facilities.

Without the property tax, these services would be underfunded. Also resulting in a decrease in the community’s quality of life.

Property Tax in Toronto

Property tax is an important source of revenue for the city of Toronto. The amount of property tax you pay in Toronto is determined by the assessed value of your property and the city’s tax rate. Toronto’s property tax rates are modest in comparison to other Canadian cities.

Toronto’s Property Tax System

The property tax system in Toronto is intend to be fair and equal. The amount you pay is proportional to the value of your property.

This means that homeowners with higher-valued houses pay more in property taxes, while those with lower-valued properties pay less. This method ensures that everyone contributes their fair amount to public service funding.

How Property Tax is Calculated in Toronto

Toronto’s property values are assesse by the Municipal Property Assessment Corporation (MPAC). The city-set property tax rate is then apply to the assessed value to determine the amount of property tax owing. The rate of taxation varies according to the type of property (residential, commercial, etc.).

The Role of MPAC

MPAC is an autonomous, non-profit company supported by all municipalities in Ontario. It is their responsibility to determine the worth of all properties in Ontario.

They accomplish this by analysing nearby property sales as well as the physical aspects and features of your property. The assesse value provided by MPAC is use by the city to calculate your property tax lookup in Toronto.

Setting the Tax Rate

The city council of Toronto determines the property tax rate as part of the annual budget process. The rate is decide by the amount of income require to fund the city’s budget.

Different tax rates are determined for various sorts of properties, such as residential, commercial, and industrial.

How to Look Up Property Tax in Toronto

Performing a property tax lookup in Toronto is straightforward. For this purpose, the City of Toronto provides an online service.

The Property Tax Lookup tool allows you to examine your account details and even alter your mailing address. This application also provides fast home tax estimates to help you plan and budget.

Using the Property Tax Lookup Tool

The property tax lookup in Toronto tool is easy to use. You simply enter your address or roll number, and the tool returns your property tax information. You may see your property’s assessed value, the tax rate that was applied, and the total amount of property tax you owe.

This application is a wonderful resource for homeowners because it allows you to check your property tax details quickly and easily.

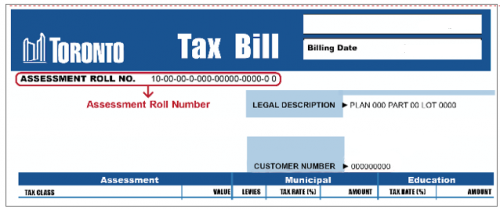

Understanding Your Property Tax Bill

In Toronto, your property tax bill contains several components. The assessed value of your property, the tax rate, and any relevant rebates or charges are the key components. It’s critical to comprehend each component in order to pay the exact amount.

Breaking Down Your Property Tax Bill

Your property tax statement may appear complicated at first glance, but if you grasp the many components, it becomes rather simple. The first component is your property’s assessed value as established by MPAC. This is the amount on which your property tax is calculated.

The tax rate is the next section. This is the rate decide by the city council and applied to the assessed value of your property. The tax rate varies according to the type of property you own.

Finally, any appropriate rebates or charges may be include in your bill. For example, if you qualify for a property tax refund programme, your payment will reflect this. Similarly, any extra charges or levies impose on your property will be reflect in your account.

How to Pay Your Property Tax in Toronto

There are several ways to pay your property tax lookup in Toronto. You can pay online through the MyToronto Pay platform, by mail, or in person at a designated location. It’s important to pay your property tax on time to avoid penalties.

Online Payment

The MyToronto Pay site is the most convenient way to pay your property tax in Toronto. You can pay your property tax from the comfort of your own home at any time that is convenient for you. You can also set up automatic payments to avoid missing payments.

Mail and In-Person Payment

You can also pay your property tax by mail or in person if you want. To pay by mail, simply submit a cheque or money order to the Revenue Services department of the city. You can pay in person at one of the city’s designated payment places.

Property Tax Relief Programs in Toronto

For qualifying homeowners, the City of Toronto offers many property tax relief programmes. These programmes can help you lower the amount of property tax you incur, making owning a house in Toronto more reasonable.

| Program | Description |

| Property Tax Increase Deferral Program | This programme allows low-income and people with disabilities to postpone property tax hikes. |

| Property Tax Increase Cancellation Program | This programme cancels property tax increases for qualified low-income and people with disabilities. |

| Property Tax, Water & Solid Waste Relief Program | This programme reimburses qualified low-income and people with disabilities for their property tax, water, and solid waste expenses. |

| Heritage Property Tax Rebate Program | Owners of qualified heritage properties are eligible for a tax credit under this programme. |

| Vacant Commercial and Industrial Tax Rebate Program | Owners of qualified unoccupied commercial and industrial properties are eligible for a tax credit under this programme. |

Final Thought

Understanding and managing your property tax is an important part of homeownership in Toronto. With the city’s online tools, performing a property tax lookup in Toronto is easier than ever. Stay informed and make sure you’re paying the right amount.

For more information, visit the City of Toronto’s Property Tax page. If you have any questions, you can contact the city’s Revenue Services at 416-392-CITY (2489) or [email protected].

Youtube Video About Property Tax Lookup in Toronto

You May Also Like

Illinois Grocery Tax Returns and Gas Tax Rises for Second Time This Year

FAQ

MPAC evaluates the worth of all properties in Ontario. Their assessed value is used to compute your property tax.

Typically, property tax is pay in two installments: an interim payment and a final bill.

Property tax arrears can result in penalties and interest costs. In exceptional circumstances, the city may sell your property to recover unpaid taxes.

The Property Tax Lookup tool is a City of Toronto online application that allows you to check your property tax details.

The City of Toronto offers several property tax relief programs for eligible homeowners, including the Property Tax Increase Deferral Program, Property Tax Increase Cancellation Program, Property Tax, Water & Solid Waste Relief Program, Heritage Property Tax Rebate Program, and Vacant Commercial and Industrial Tax Rebate Program.