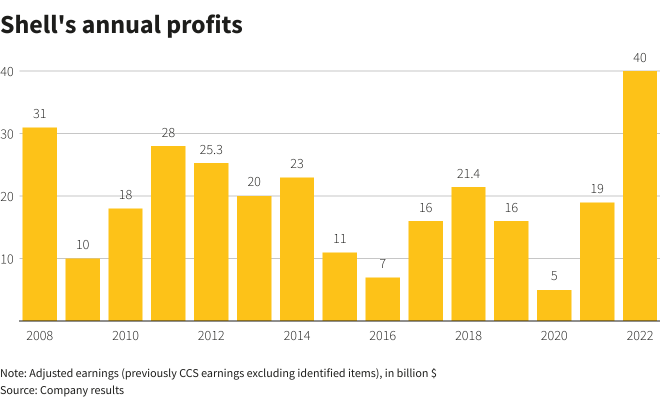

Rising Profits of Shell: $6.2bn Earnings Amid Oil Price Fluctuations

The oil industry behemoth, Shell, has once again made headlines with its impressive Q3 earnings, epitomizing the Rising Profits of Shell in an ever-changing oil market landscape.

The company recently announced a profit of $6.2 billion which’s a significant increase compared to the previous quarter.

However when we compare it to the period year, where they made $9.4 billion due, to geopolitical tensions, in Ukraine there is a noticeable decline.

Although oil prices are not as high as they were year they have seen a surge. This can largely be attributed to the decisions made by the Opec+ group of oil producing nations, who have reduced their output in order to stabilize the market.

World Bank’s Forecast and Its Implications

This week the World Bank made a statement that could have consequences, for the oil industry. They suggested that the ongoing conflicts in the Middle East could potentially cause crude oil prices to skyrocket to a $150 per barrel which’s a stark difference, from the current price of $85.

The Rising Profits of Shell over the recent three-month span have registered a 23% uptick from the previous quarter.

This recent improvement, in the situation is the result of oil prices, enhanced extraction of oil and gas and higher revenue generated from refining and trading activities related to gas.

However, the Rising Profits of Shell are not without their share of critiques. Shells recent announcement of a $3.5 billion share buyback initiative and a projected total shareholder return of $23 billion, for this year has raised concerns among some individuals.

Critics contend that the companys emphasis on short term profits may be overshadowing the requirement for investments, in more sustainable energy alternatives.