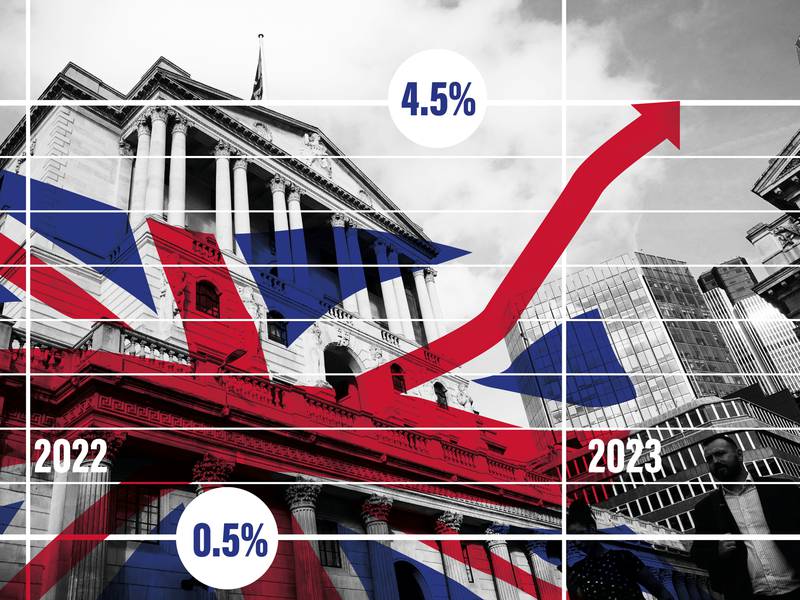

UK Interest Rates Rise: A Fourteenth Consecutive Hike Expected

The Bank of England is set to raise interest rates for the 14th time in a row, marking another chapter in the UK Interest Rates Rise story. This move is part of the Bank’s ongoing efforts to curb the stubbornly high inflation rates.

Most economists predict an increase in the base rate from the current 5% to 5.25% by the end of the day. This consistent UK Interest Rates Rise is a response to the economic conditions in the country.

UK Interest Rates Rise on Borrowers and Savers

The UK Interest Rates Rise will have a direct impact on the cost of borrowing and the returns on savings. For some people, this means higher interest rates on mortgages and loans.

On the flip side, savers can expect to see higher returns on their savings. The UK Rates Rise is a double-edged sword, benefiting savers while making borrowing more expensive.

Inflation in the UK, which measures the rate of price increases, is currently much higher than usual. This is putting a strain on households.

The last time interest rates were at 5.25% was 15 years ago, in April 2008. However, the proposed rise to 5.25% is less dramatic than July’s sharp increase from 4.5% to 5%. The UK Interest Rise is a response to this high inflation, aiming to stabilize the economy.

The Balancing Act of the Rates Rise

The Bank of England’s goal with the UK Interest Rates Rise is to make borrowing more expensive, thereby reducing spending. This, in turn, should lead to a decrease in price rises. However, it’s a delicate balance.

If rates are raised too aggressively, it could cause the economy to slump. But if they’re not raised at all, inflation could rise even more. The UK Interest Rise is thus a balancing act, aiming to control inflation without harming the economy.

The UK Interest Rates Rise has sparked concerns among some economists. The Institute of Economic Affairs (IEA), a free-market think tank, has suggested that the Bank should wait for previous interest rate rises to take effect before raising rates further.

They argue that further rate rises could potentially harm the economy without necessarily lowering inflation any faster.

The UK Interest Rates is a complex issue with far-reaching implications. As the situation continues to unfold, it will be crucial to monitor the effects on the economy, borrowing costs, and inflation rates.