How to Build a +scalping Strategy Using Adaptrade

Different techniques can be used to maximise profits and minimise risks in the fast-paced world of trading. Scalping is one such strategy, which entails placing multiple transactions in a day to profit from slight price swings.

This post provides a comprehensive guide on how to build a +scalping strategy using Adaptrade, a powerful software designed for strategy building and testing.

Table of contents

- Understanding Scalping

- What is Adaptrade?

- Features and Benefits of Adaptrade

- Getting Started with Adaptrade

- Building a Scalping Strategy with Adaptrade

- Define the Market and Timeframe- How to Build a +scalping Strategy Using Adaptrade

- Set Up Initial Conditions and Parameters

- Configure Strategy Options- How to Build a +scalping Strategy Using Adaptrade

- Run the Build Process

- Interpret the Results- How to Build a +scalping Strategy Using Adaptrade

- Fine-Tune the Strategy

- Backtesting Your Scalping Strategy- How to Build a +scalping Strategy Using Adaptrade

- Pros and Cons of Building a Scalping Strategy Using Adaptrade

- Risk Management in Scalping

- Real-time Trading with Your Scalping Strategy

- Final Thought

- Youtube Video

- FAQ

Understanding Scalping

Scalping is a trading method that entails purchasing and selling a financial asset in a very short period of time, frequently in a matter of minutes or even seconds. The idea is to profit from minor price fluctuations.

Why Scalping?

Scalping is popular with day traders for a variety of reasons. For starters, it enables traders to profit from minor price fluctuations that would otherwise be insignificant in larger trading methods.

Second, it might offer a plethora of trading possibilities throughout the day. Finally, because trades are often closed within the day, it allows for speedy outcomes.

However, scalping has its own set of difficulties. Making many trades during the day necessitates a large time investment.

Due to the frequency of trades, it also incurs substantial transaction fees. Furthermore, it necessitates a deep awareness of the market as well as swift decision-making abilities.

What is Adaptrade?

Adaptrade is sophisticated software that assists traders in developing and testing trading strategies. It generates strategies based on user-defined performance criteria using powerful algorithms.

Features and Benefits of Adaptrade

Adaptrade offers a range of features that make it a powerful tool for building trading strategies. These include:

- Strategy Building: Adaptrade employs genetic programming to build trading strategies automatically. This opens the door to a wide range of possible techniques, from simple to sophisticated.

- Backtesting: Adaptrade provides complete backtesting capabilities, allowing you to test and analyse your strategy using historical data.

- Optimization: Adaptrade supports significant optimisation, allowing you to fine-tune your strategy for maximum performance.

- Risk Management: Adaptrade includes features for managing risk, such as stop loss and take profit settings.

The key advantage of how to build a +scalping strategy using Adaptrade is that it allows for extensive backtesting and optimization, ensuring that the strategy you develop is robust and reliable.

Getting Started with Adaptrade

To start how to build a +scalping strategy using Adaptrade, you first need to download and install the software.

Once installed, you may use its user-friendly interface to create your trading account. This entails entering your account information and selecting your trading preferences.

Building a Scalping Strategy with Adaptrade

Creating a successful scalping strategy requires careful planning and execution. With Adaptrade, the process becomes more manageable and efficient. Let’s delve into how to build a +scalping strategy using Adaptrade:

Define the Market and Timeframe- How to Build a +scalping Strategy Using Adaptrade

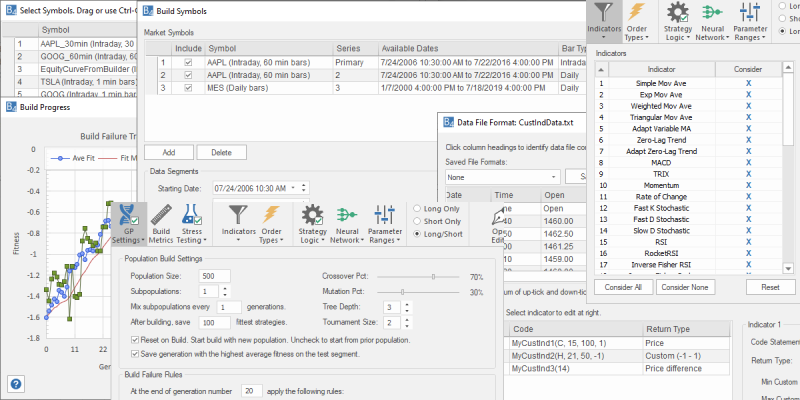

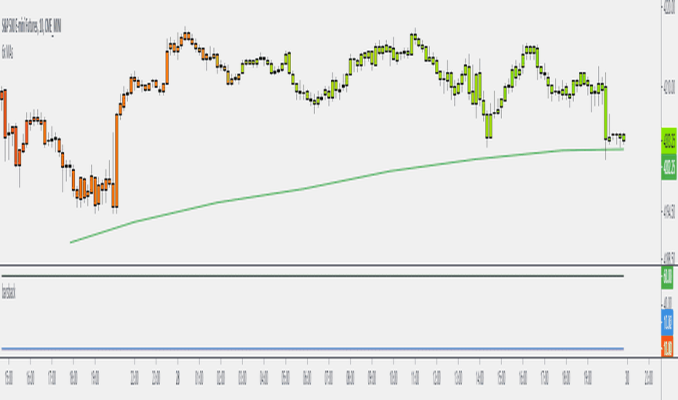

The first step in how to build a +scalping strategy using Adaptrade is to define the market and timeframe. The market is the name given to the financial asset that you intend to trade, such as stocks, currencies, commodities, or indexes.

The period relates to the duration of each trade, which is often very brief in scalping – often only a few minutes or even seconds.

Set Up Initial Conditions and Parameters

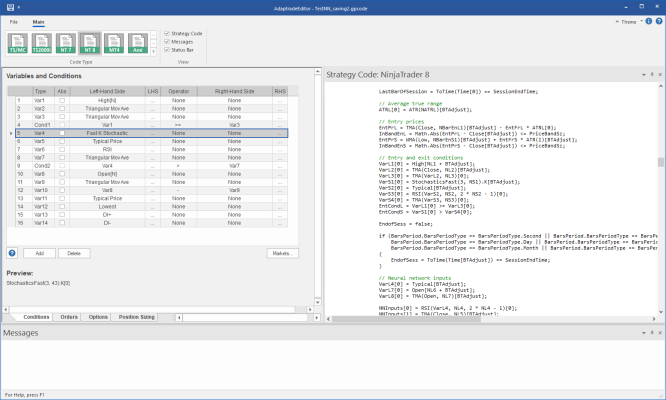

Following the definition of the market and period, the following stage is to establish the initial conditions and specifications.

This includes establishing your entry and exit criteria, as well as your stop loss and take profit levels and other trading settings.

These criteria will direct the software in developing a strategy that is appropriate for your trading style and risk tolerance.

Configure Strategy Options- How to Build a +scalping Strategy Using Adaptrade

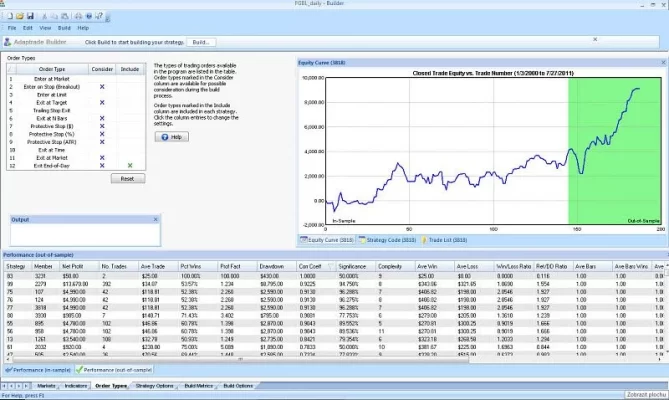

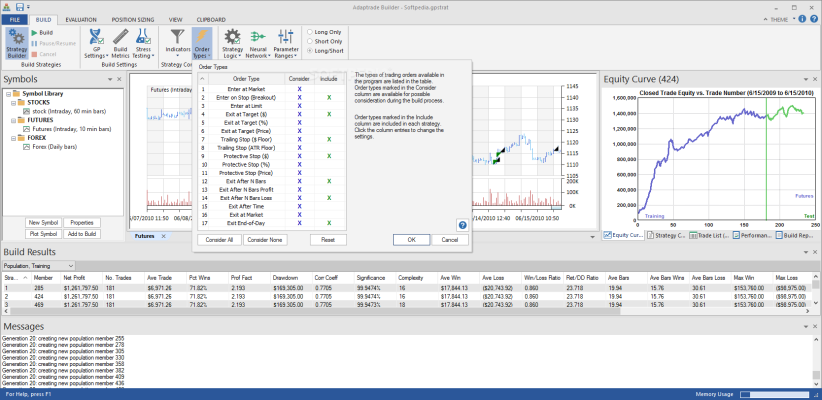

The third step in how to build a +scalping strategy using Adaptrade is to configure the strategy options. Adaptrade provides a variety of strategy building choices that you can tailor to your own requirements.

Options include strategy type (e.g., long, short, or both), number of entry and exits, maximum holding period, and more.

Run the Build Process

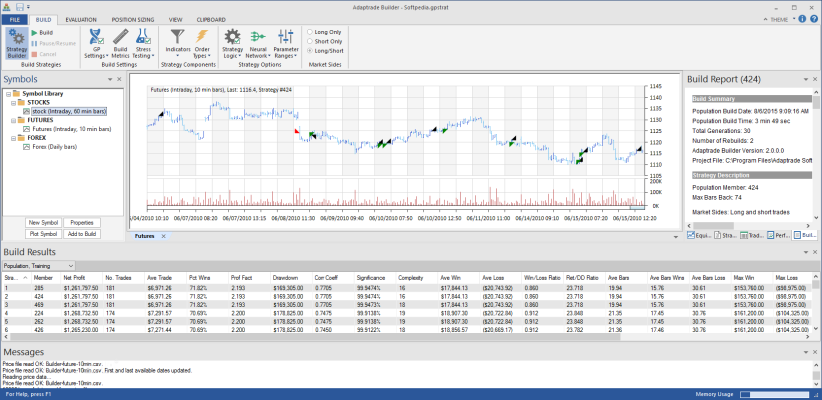

It’s time to begin the build process after you’ve defined your criteria and strategy settings. Adaptrade’s powerful algorithms come into play here.

Based on your settings, the software will build a plan, use genetic programming to identify the best possible strategy that matches your criteria.

Interpret the Results- How to Build a +scalping Strategy Using Adaptrade

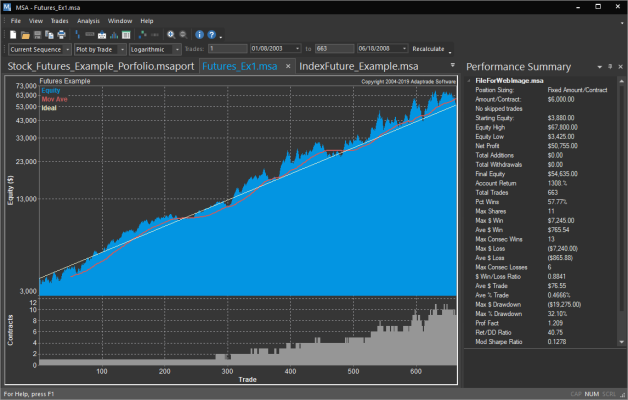

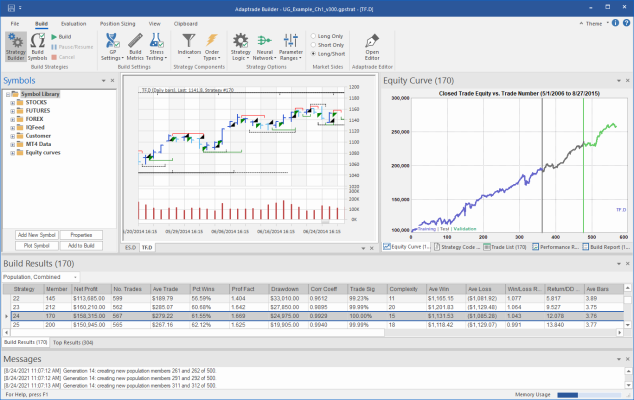

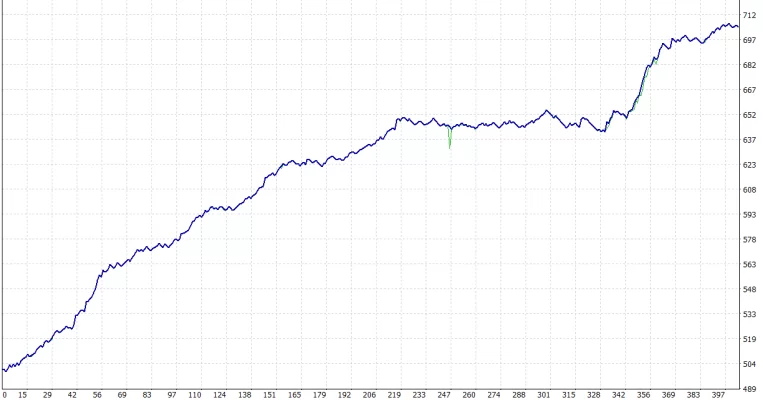

Following the completion of the construction process, the results must be interpreted. Adaptrade gives a thorough performance report for the approach, containing key indicators such as net profit, drawdown, number of trades, win rate, and more. It also includes an equity curve to show how the approach has performed over time.

Fine-Tune the Strategy

The final step in how to build a +scalping strategy using Adaptrade is to fine-tune the strategy. You may need to alter the settings or strategy options based on the results to increase the strategy’s performance.

To construct a strong and profitable scalping strategy, this process may entail numerous iterations of building, testing, and fine-tuning.

You may also like: Forehead Reduction Surgery

Backtesting Your Scalping Strategy- How to Build a +scalping Strategy Using Adaptrade

An essential part of how to build a +scalping strategy using Adaptrade is backtesting. This entails evaluating your strategy’s performance using previous data.

Adaptrade provides extensive backtesting capabilities, allowing you to evaluate the effectiveness of your strategy before putting it in the live market.

Pros and Cons of Building a Scalping Strategy Using Adaptrade

| Pros | Cons |

| Automated Strategy Building: Saves time and effort | Requires Trading Knowledge: Users need to understand trading basics |

| Backtesting Tools: Provides insights into strategy performance | Market Condition Dependent: Strategies can be influenced by market changes |

| Customizable Parameters: Allows for strategy personalization | Risk of Overfitting: Too much optimization can lead to overfitting |

| Risk Management Features: Helps protect capital | Software Cost: Adaptrade is a paid software |

Risk Management in Scalping

Because of the large number of trades involved in scalping, risk management is critical. Adaptrade provides a number of risk management tools, such as stop loss and take profit settings, that can be integrated into your scalping technique.

Remember that a solid scalping technique is about more than just profit; it’s also about capital preservation.

Real-time Trading with Your Scalping Strategy

Once you’re satisfied with your backtesting results, the final step in how to build a +scalping strategy using Adaptrade is to transition to real-time trading. Keep a careful eye on the performance of your plan and be ready to make changes if market conditions change.

Adaptrade Builder Download

If you want to download Adaptrade Builder you should go to the Adaptrade website. They usually offer a trial version that lets you assess the software before buying it. Remember, using authorized sources ensures that you get the most secure version of the software well as access, to customer support and updates.

Adaptrade Builder vs StrategyQuant

Adaptrade Builder and StrategyQuant are both known tools used for developing trading strategies. Each tool has its features and strengths. Adaptrade Builder is popular, for its user interface. Is especially effective in generating and optimizing trading strategies for stocks, futures and forex markets.

It offers a range of customization options. On the hand StrategyQuant stands out with its emphasis on algorithmic trading. It caters to markets including cryptocurrencies. Is highly regarded for its advanced backtesting capabilities and strong community support.

While Adaptrade Builder usually requires a one time purchase StrategyQuant offers subscription based models as purchase options. The choice between the two depends on the traders needs, market focus and desired level of complexity in strategy development.

To download Adaptrade Builder legitimately it is recommended to visit the website where a trial version’s often available for evaluation before making a purchase decision. This ensures access, to the features, security measures and support services.

Final Thought

How to build a +scalping strategy using Adaptrade involves understanding scalping, setting up Adaptrade, defining your strategy parameters, backtesting, and finally, real-time trading.

You can develop a profitable scalping strategy that satisfies your trading objectives if you give it sufficient thought and use the appropriate tools.

Youtube Video

FAQ

Adaptrade is a strong tool for developing a scalping strategy since it provides automatic strategy construction, thorough backtesting capabilities, adjustable parameters, and risk management features.

While Adaptrade automates strategy development, a basic understanding of trading and scalping methods is required to select the appropriate settings.

Market conditions can have an impact on the success of the strategies generated by Adaptrade. It is critical to assess the performance of your plan and make adjustments when market conditions change.

Overfitting occurs when a strategy is overly tuned to previous data and may underperform on new data. While Adaptrade offers optimisation tools, it is critical to avoid overfitting by ensuring your strategy is strong and not extremely complex.

No, Adaptrade is a paid software. Some users may find the cost prohibitive, but many believe the capabilities and benefits it provides to be well worth the price.